The solar industry in the United States is booming. To date, more than 130 GW of solar capacity has been installed across the country, with plans to install a further 480 GW over the next 10 years. Driving the focus on solar energy is the need to reduce carbon emissions as well as the sharp decline in the cost of solar (down 53% over the last 10 years).

If you are a commercial property manager, installing solar panels on your property may interest you. The commercial solar tax credit is a means for businesses and other organizations such as nonprofits and local governments to purchase solar energy systems at an affordable price.

In this blog post, we will highlight everything you need to know about solar tax credit eligibility, looking ahead to 2023 and beyond. We will focus on the investment tax credit (ITC) and the production tax credit (PTC), highlighting which option is best for your business. Let’s get started.

Understanding ITC and PTC

As noted, there are two available tax credits for businesses and other organizations. These differ from the federal investment tax credit for residential solar photovoltaics. Normally, businesses are unable to claim both tax credits for the same property.

The ITC is a tax credit that reduces the federal income tax liability for a certain percentage of a solar system’s cost during the tax year in which installation occurs.

On the other hand, the PTC is a per-kilowatt-hour tax credit for the electricity generated by solar (as well as other qualifying technologies) across the first 10 years of a system’s operation. Adjusted annually for inflation, the PTC reduces federal income tax liability.

In the case of the ITC, solar systems that are installed before 2033 are eligible for a 30% tax credit. For PTC, solar systems are eligible for a 2.6 ¢/kWh tax credit (if they are under 1 MW in size or meet the labor requirements issued by the Treasury Department).

After 2033, these tax credits will be gradually decreasing and will end in 2036, unless there is an extension by Congress.

What Projects Are Eligible?

In order to be eligible for either the ITC or the PTC, there are a number of criteria that businesses and organizations must meet. They must be located either within the United States or US territories, for example.

Other criteria include that the solar system must be new or “limited previously used” and not leased to a tax-exempt entity (such as a school).

Which Option Is Best for Businesses?

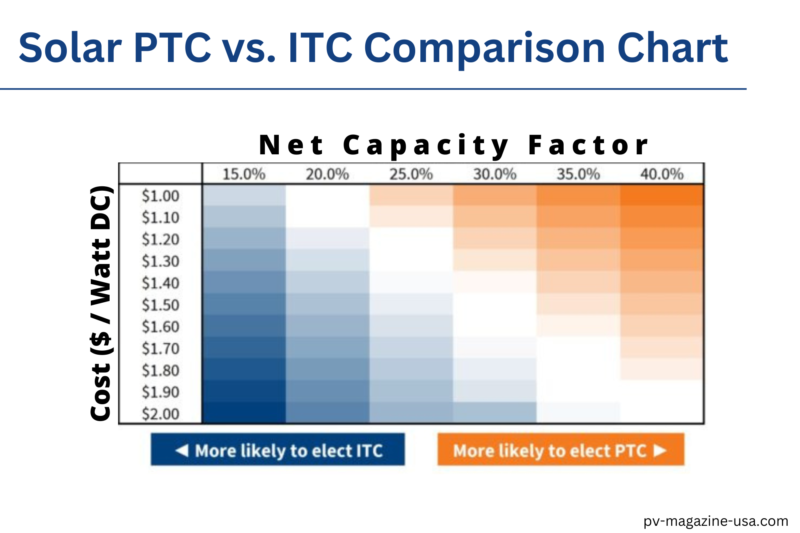

Whether a business chooses the ITC or the PTC depends on a number of factors. These include the cost of the project, and whether it is eligible for any bonus tax credits. It also includes the amount of sunlight available in the area.

Whereas the ITC is an upfront tax credit (currently at 30%) that does not vary by solar system performance, the PTC may provide a better cash flow given that the tax credits are earning over time.

Generally speaking, a large-scale solar project will receive more value by opting for the PTC in a sunny place (such as California, for example). On the other hand, a solar project that is located in an area that receives less sunlight or incurs high installation costs may benefit more from the ITC.

In the case of small-scale solar projects, they generally receive more value through the ITC. This is especially true if they utilize a low-income bonus, something that is not available with the PTC.

Eligible Expenses for the ITC

The calculation of ITC is based on the cost of building the solar system. The PTC is calculated based on the amount of electricity that a system produces. For the ITC, therefore, it is important to understand the eligible expenses in order to determine the tax credit that a solar system is eligible for.

When a business is calculating the ITC, it is necessary to multiply the tax credit percentage by the amount spent on what’s known as eligible property. Eligible properties include:

- Solar panels, inverters, balance-of-system equipment, and racking

- Concentrating solar-thermal power (CSP) technology (necessary to generate electricity)

- Solar system installation costs

- Surge arrestors, step-up transformers, and circuit breakers

- Energy storage devices (capacity of 5-kilowatt hours or more)

- Interconnection property costs (for projects 5 MW or less)

Structures holding a solar system may also be eligible for the ITC. This happens in cases where other uses of the structure are merely incidental.

Bonus Credits for ITC and PTC

There are a number of additional credits that the ITC and the PTC may qualify for. These include:

- Domestic content bonus (when a certain percentage of used materials come from the United States)

- Energy community bonus (depends on the specific area where the installation of the system is occurring)

- Low-income bonus (note that this is only available to projects using the ITC)

In the case of the latter, solar projects may be eligible for up to an additional 20%. This occurs if classified as qualified low-income economic benefit projects or qualified low-income residential building projects.

Understand the Commercial Solar Tax Credit Guide 2023

There are many benefits for businesses that choose to make the switch to solar energy. These include cutting overhead business costs, creating energy independence, and the above tax benefits.

If you are interested in learning more about making a commercial solar tax credit claim, speak to the expert team at Property Manager Insider. We are a free resource for property managers providing industry news and insights. Click here to contact us today. We look forward to hearing from you.